Two Harbors Investment Corp. January

2010 Investor Presentation

Forward-Looking Statements

This presentation may include “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual

results may differ from expectations, estimates and projections and, consequently, investors should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “assume,” “target,”

“range,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward- looking statements involve significant risks and uncertainties that could cause

actual results to differ materially from expected results. Factors that may cause such differences include, among other things, Two Harbors’ ability to acquire target assets and to achieve its plans and expectations regarding its investment

program, Two Harbors’ ability to estimate and achieve expected yields from its assets, Two Harbors’ ability to realize attractive overall returns from its investments, and Two Harbors’ ability to manage and mitigate risks associated with

its investment portfolio.

Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. There can be no assurance that actual results will not differ materially from our expectations.

Two Harbors cautions investors not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to

any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information is contained in Two Harbors’ filings with the Securities

and Exchange Commission (“SEC”). You may obtain these reports from the SEC’s website at www.sec.gov

..

All subsequent written and oral forward-looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety

by the cautionary statements above.

Safe Harbor Statement

2

Two Harbors Investment Corp. (NYSE Amex: TWO; TWO.WS) completed its merger transaction with Capitol Acquisition Corp. on October 28, 2009.

Two Harbors commenced operations as a REIT investing in residential mortgage- backed securities on October 29, 2009.

The transaction generated approximately $124 million in cash for investments.

As of December 8, 2009, the Company has deployed approximately 95% of its capital available for investment. The initial portfolio includes approximately $488 million of Agency and non-Agency

bonds.

On December 21, 2009, the Company announced a fourth quarter 2009 dividend of $0.26 per share

1.

Key Highlights

The Company distributes dividends based on its current estimate of taxable earnings per common share, not GAAP earnings. This fourth quarter 2009 dividend may not be indicative of future dividend

distributions.

3

Value-driven investing philosophy coupled with a holistic approach which evaluates securities across all subsets of the non-Agency and Agency RMBS universe.

Dynamic portfolio in which the asset allocation evolves with changing market opportunities.

Portfolio construction emphasizes diversification and focuses on balancing various risks, such as interest rate, prepayment, and credit risks.

Strong focus on risk management to maximize risk-adjusted returns while balancing book value preservation.

Externally managed by PRCM Advisers LLC, a subsidiary of Pine River Capital Management L.P. Attractive 1.5% management fee structure based on shareholder’s equity with no additional

performance fees.

Two Harbors’ Business Overview

4

Executive Team with Deep Securities Experience

Chief Executive

Officer

Steve Kuhn

Also serves as Partner - Head of Fixed Income Trading at Pine River.

Goldman Sachs Portfolio Manager from 2002 to 2007.

17 years investing in and trading mortgage backed securities and other fixed income securities for firms including Goldman Sachs Asset Management, Citadel and Cargill.

Bill Roth

Also serves as Portfolio Manager in the New York Office of Pine River.

Citi and Salomon Brothers 1981 - 2009; Managing Director since 1997.

28 years in mortgage securities market; Managing Director in Citi and Salomon Brothers’ proprietary trading group managing MBS and ABS portfolios.

Co-Chief Investment

Officers

Thomas Siering

Also serves as Partner - Head of Fundamental Strategies at Pine River.

Previously head of Value Investment Group at EBF & Associates; Partner since 1997.

23 years of investing and management experience; commenced career at Cargill where he was a founding member of Financial Markets Department.

Chief Financial

Officer

Jeffrey Stolt

Partner and Co-founder of Pine River Capital Management in 2002.

EBF & Associates from 1989 to 2002; Controller since 1997. Commenced his career at Cargill in the Financial Markets Department.

5

Experienced, Cohesive Team:

Six partners together for average of 15 years.

Average 19 years hedge fund experience.

67 employees, 24 investment professionals.2

No senior management turnover.

Historically low attrition.

Overview of Pine River Capital Management

Founded June 2002 with offices in New York, London, Hong Kong, San Francisco and Minnesota.

Over $1.4 billion assets under management.1

Experienced manager of non-Agency, Agency and other mortgage related assets.

Demonstrated success in achieving growth and managing scale.

Established Infrastructure:

Strong corporate governance.

Registrations: SEC/NFA (U.S.), FSA (U.K.), SFC (Hong Kong), SEBI (India) and TSEC (Taiwan).

Proprietary technology.

Global footprint.

Minnetonka, MN • London • Hong

Kong • San Francisco • New York

Global multi-strategy asset management firm providing comprehensive portfolio management, transparency and liquidity to institutional and high net worth investors.

Estimate as of January 1, 2010. Assets under management includes Two Harbors.

Employee headcount as of January 1, 2010.

6

Pine River Offers Extensive MBS Expertise

Trading Team: 3 Traders / 2 Analysts2

Trader A - Formerly Goldman Sachs Asset Management, risk management.

Trader B - Formerly UBS Securities, member of top mortgage sales team.

Trader C - Formerly Citi, member of proprietary trading group.

Analyst A - Formerly Credit Suisse, member of RMBS trading group.

Analyst B - Formerly Ivy Square Limited, RMBS analyst and trader.

Repo Analyst

Repo Funding Analyst - 20 years financing experience at EBF & Associates and Cargill.

Estimate as of January 1, 2010. Assets under management includes Two Harbors.

Employee headcount as of January 1, 2010.

Over $1.4 billion assets under management of which approximately $650 million is in mortgage-backed securities and other fixed income strategies.1

Experienced RMBS Team

Investment Approach

Continuous top-down market assessment to identify most attractive segments.

Detail analyses to find the most mispriced securities.

Idea generation originates from all team members.

Investment ideas are vetted by both Co- Chief Investment Officers.

Collegial and entrepreneurial team environment.

7

Market Opportunity

Traditional providers of capital have left the market.

Fannie Mae & Freddie Mac, historically the overseers of relative value and effectively the world’s two largest mortgage “hedge funds”, cannot participate in the current price

discrepancies.

The capital bases of traditional market participants such as proprietary trading desks and hedge funds have been reduced.

Opportunities exist for attractive loss-adjusted returns in the non-Agency mortgage market as a result of forced selling by numerous holders (i.e. – banks, SIVs, insurance companies).

Two Harbors is positioned to capitalize upon dislocations in the $11.0 trillion U.S. mortgage market.1

FBR Miller.

8

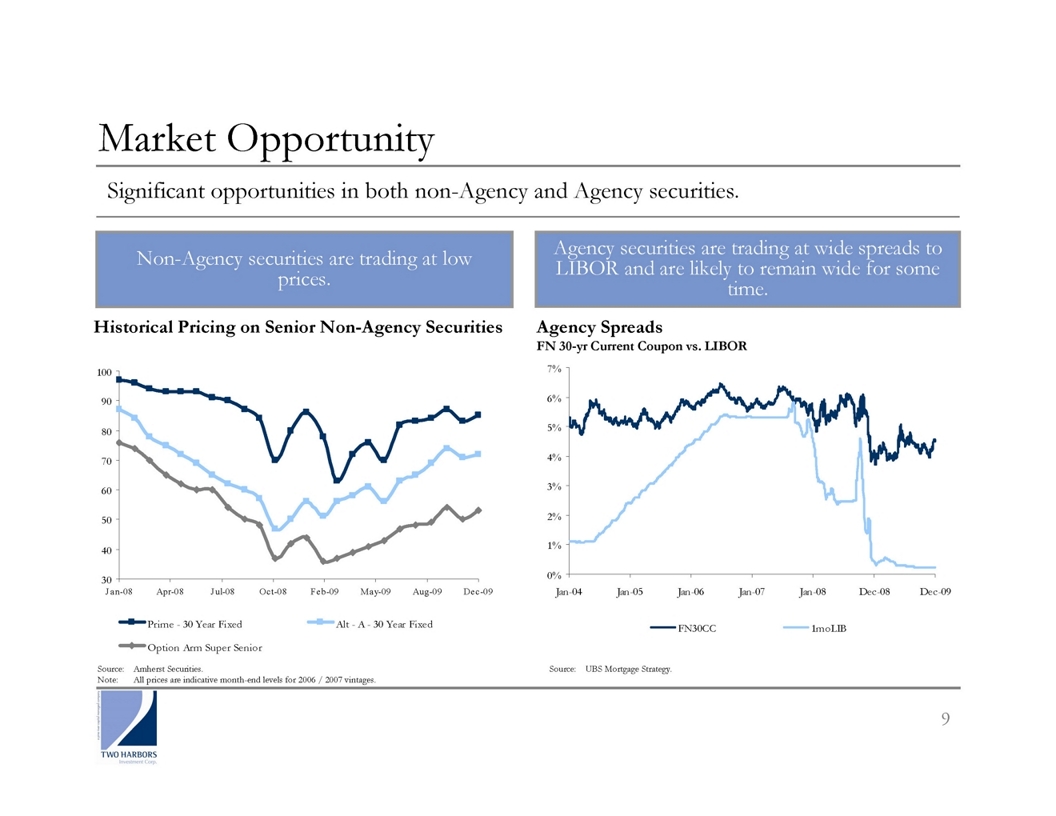

Option Arm Super Senior

Alt - A - 30 Year Fixed

Prime - 30 Year Fixed

Dec-09

Aug-09

May-09

Feb-09

Oct-08

Jul-08

Apr-08

Jan-08

100

90

80

70

60

50

40

30

Non-Agency securities are trading at low prices.

Significant opportunities in both non-Agency and Agency securities.

Source: Amherst Securities.

Note: All prices are indicative month-end levels for 2006 / 2007 vintages.

Market Opportunity

FN 30-yr Current Coupon vs. LIBOR

Agency Spreads

Historical Pricing on Senior Non-Agency Securities

Source: UBS Mortgage Strategy.

Agency securities are trading at wide spreads to LIBOR and are likely to remain wide for some time.

0%

1%

2%

3%

4%

5%

6%

7%

Jan-04

Jan-05

Jan-06

Jan-07

Jan-08

Dec-08

Dec-09

FN30CC

1moLIB

9

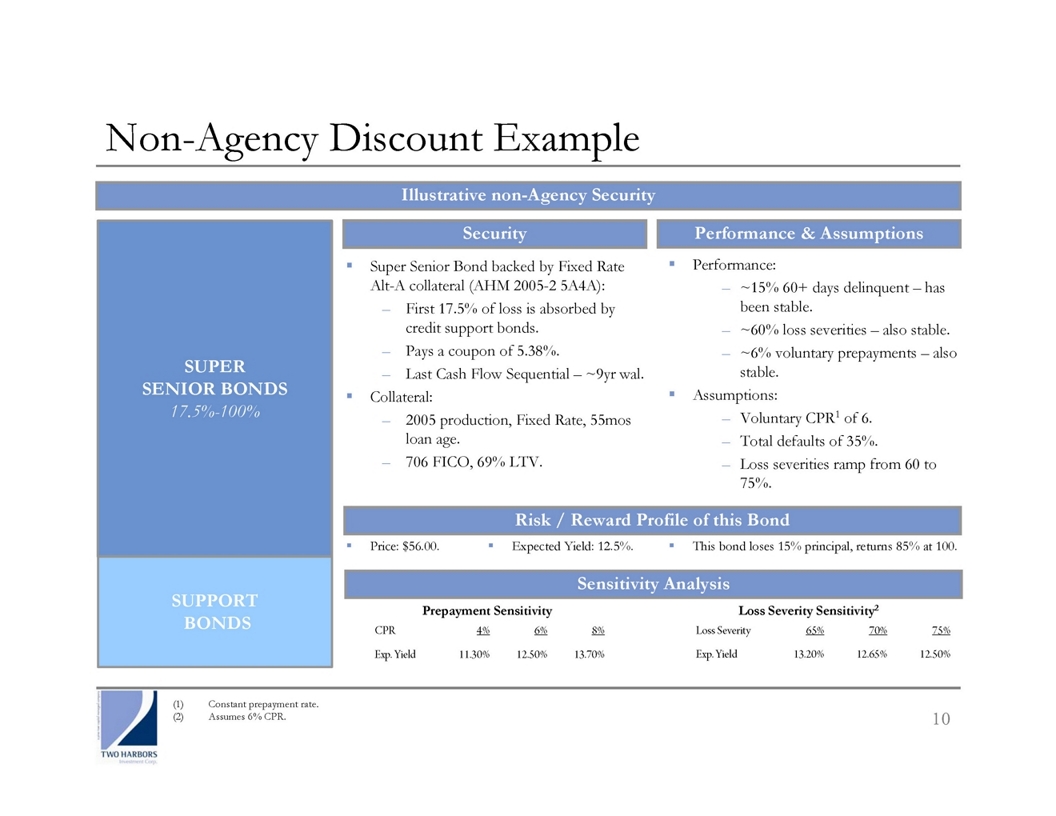

Non-Agency Discount Example

Super Senior Bond backed by Fixed Rate Alt-A collateral (AHM 2005-2 5A4A):

First 17.5% of loss is absorbed by credit support bonds.

Pays a coupon of 5.38%.

Last Cash Flow Sequential – ~9yr wal.

Collateral:

2005 production, Fixed Rate, 55mos loan age.

706 FICO, 69% LTV.

SUPER

SENIOR BONDS

17.5%-100%

Illustrative non-Agency Security

SUPPORT

BONDS

Performance:

~15% 60+ days delinquent – has been stable.

~60% loss severities – also stable.

~6% voluntary prepayments – also stable.

Assumptions:

Voluntary CPR1 of 6.

Total defaults of 35%.

Loss severities ramp from 60 to 75%.

Price: $56.00.

Security

Performance & Assumptions

Risk / Reward Profile of this Bond

This bond loses 15% principal, returns 85% at 100.

Expected Yield: 12.5%

Constant prepayment rate.

Assumes 6% CPR.

13.70

12.50%

11.30%

Exp. Yield

8%

6%

4%

CPR

12.50%

12.65%

13.20%

Exp. Yield

75%

70%

65%

Loss Severity

Sensitivity Analysis

Prepayment Sensitivity

Loss Severity Sensitivity2

10

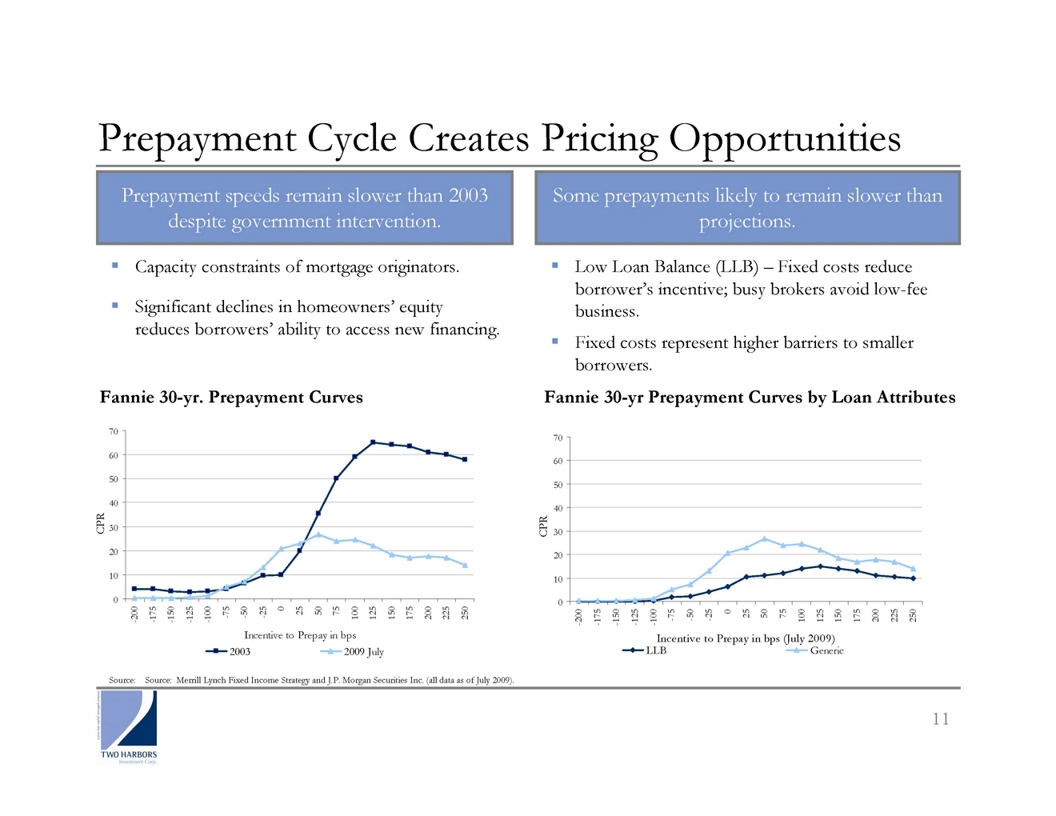

2009 July

2003

Incentive to Prepay in bps

70

60

50

40

30

20

10

0

Source: Source: Merrill Lynch Fixed Income Strategy and J.P. Morgan Securities Inc. (all data as of July 2009).

Capacity constraints of mortgage originators.

Significant declines in homeowners’ equity reduces borrowers’ ability to access new financing.

Low Loan Balance (LLB) – Fixed costs reduce borrower’s incentive; busy brokers avoid low-fee business.

Fixed costs represent higher barriers to smaller borrowers.

Prepayment speeds remain slower than 2003 despite government intervention.

Some prepayments likely to remain slower than projections.

Prepayment Cycle Creates Pricing Opportunities

Fannie 30-yr. Prepayment Curves

Fannie 30-yr Prepayment Curves by Loan Attributes

0

10

20

30

40

50

60

70

Incentive to Prepay in bps (July 2009)

LLB

Generic

11

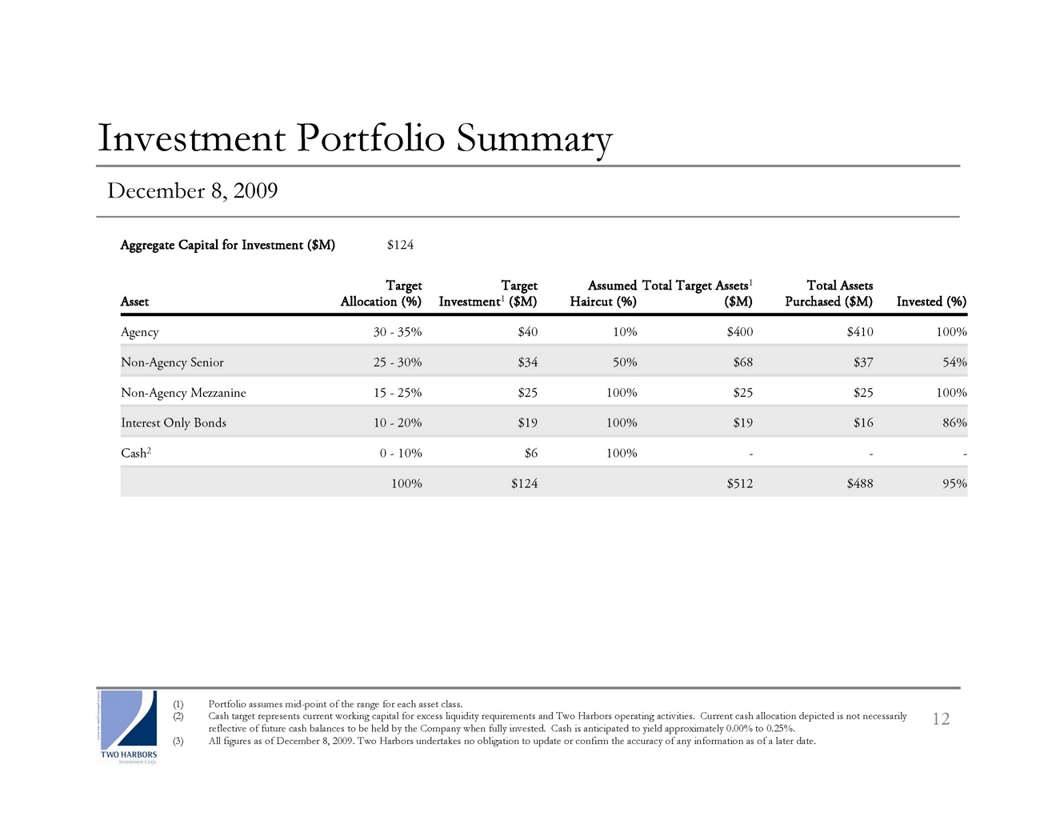

December 8, 2009

$512

-

$19

$25

$68

$400

Total Target Assets1 ($M)

$488

-

$16

$25

$37

$410

Total Assets Purchased ($M)

$124

Aggregate Capital for Investment ($M)

100%

0 - 10%

10 - 20%

15 - 25%

25 - 30%

30 - 35%

Target Allocation (%)

-

100%

$6

Cash2

95%

$124

100%

100%

50%

10%

Assumed Haircut (%)

$19

$25

$34

$40

Target Investment1

($M)

100%

Non-Agency Mezzanine

100%

Agency

54%

Non-Agency Senior

86%

Interest Only Bonds

Invested (%)

Asset

Portfolio assumes mid-point of the range for each asset class.

Cash target represents current working capital for excess liquidity requirements and Two Harbors operating activities. Current cash allocation depicted is not necessarily reflective of

future cash balances to be held by the Company when fully invested. Cash is anticipated to yield approximately 0.00% to 0.25%.

All figures as of December 8, 2009. Two Harbors undertakes no obligation to update or confirm the accuracy of any information as of a later date.

Investment Portfolio Summary

12

10-15%

-

-

$62

Total Non-Agency

-

Weighted

Average Price ($)

$38.9

$55.3

Weighted

Average Price ($)

-

$104.9

$104.6

Weighted

Average Price ($)

10-15%

Estimated

Yield Range1 (%)

12-20%

8-12%

Estimated

Yield Range1 (%)

2.60-3.00%

2.25-2.50%

4.00-4.30%

Estimated

Yield Range1 (%)

Weighted

Average Coupon (%)

Amount ($M)

Non-Agency Bonds

Weighted

Average Coupon (%)

Amount ($M)

Interest Only Bonds

2.55%

$25

Mezzanine Bonds

-

$16

Interest Only Bonds

2.86%

$37

Senior Bonds

-

4.38%

5.23%

Weighted Average

Coupon (%)

$410

$311

$99

Amount ($M)

Hybrid ARMs

Agency Bonds

Fixed Rate Bonds

Total Agency

Portfolio

December 8, 2009

Actual realized yields will depend on a number of factors that cannot be predicted with certainty, including realized prepayment speeds for Agency bonds. In addition to prepayment speeds,

actual yields will depend on the timing and extent of loan defaults and recoveries for Non-Agency bonds. Estimated yields do not include any costs of operating or managing Two Harbors and are not an indication of estimated earnings.

All figures as of December 8, 2009. Two Harbors undertakes no obligation to update or confirm the accuracy of any information as of a later date.

Investment Portfolio Composition

13

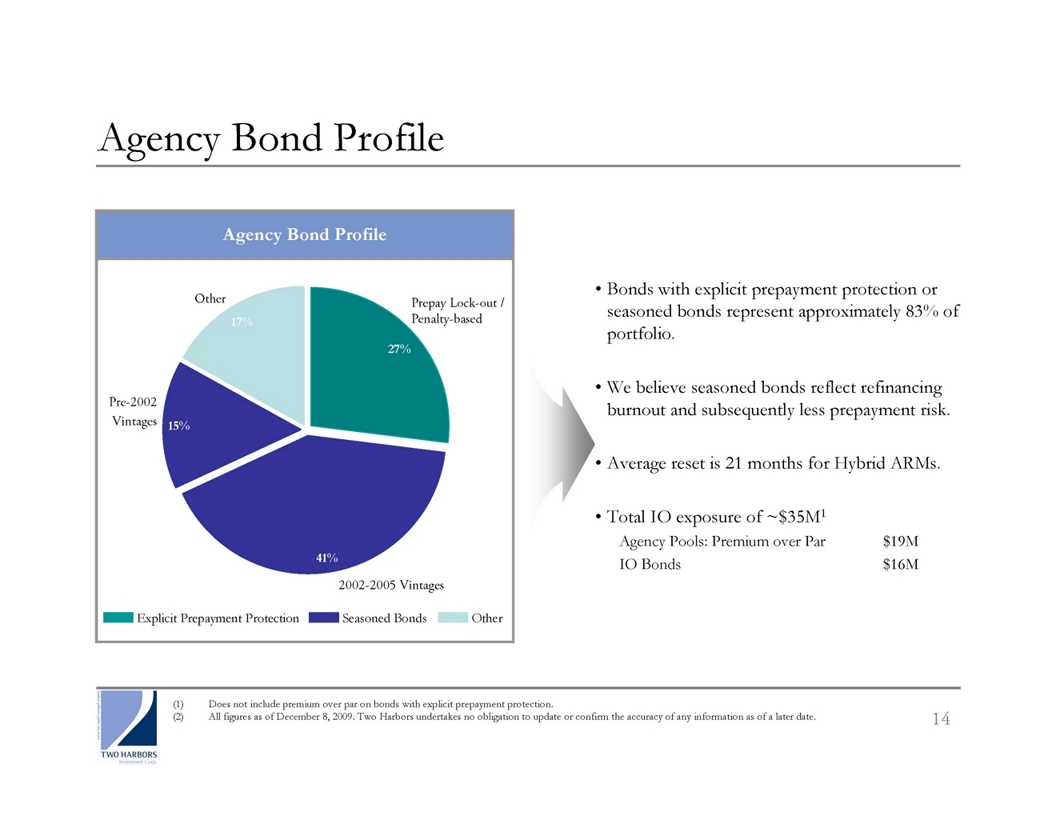

Bonds with explicit prepayment protection or seasoned bonds represent approximately 83% of portfolio.

We believe seasoned bonds reflect refinancing burnout and subsequently less prepayment risk.

Average reset is 21 months for Hybrid ARMs.

Total IO exposure of ~$35M1

Agency Pools: Premium over Par $19M

IO Bonds $16M

Does not include premium over par on bonds with explicit prepayment protection.

All figures as of December 8, 2009. Two Harbors undertakes no obligation to update or confirm the accuracy of any information as of a later date.

Agency Bond Profile

Other

Pre-2002

Vintages

2002-2005 Vintages

Prepay Lock-out / Penalty-based

Other

Seasoned Bonds

Explicit Prepayment Protection

Agency Bond Profile

41%

15%

17%

27%

14

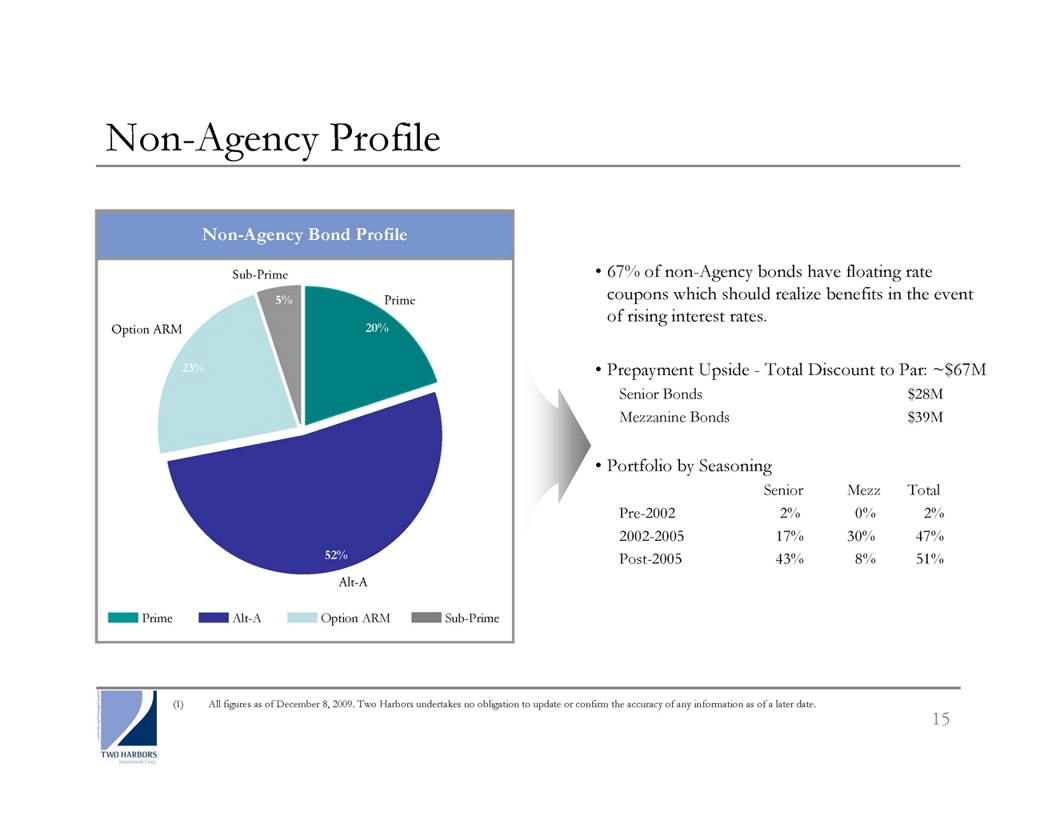

Non-Agency Bond Profile

67% of non-Agency bonds have floating rate coupons which should realize benefits in the event of rising interest rates.

Prepayment Upside - Total Discount to Par: ~$67M

Senior Bonds $28M

Mezzanine Bonds $39M

Portfolio by Seasoning

Senior Mezz Total

Pre-2002 2% 0% 2%

2002-2005 17% 30% 47%

Post-2005 43% 8% 51%

Sub-Prime

Sub-Prime

All figures as of December 8, 2009. Two Harbors undertakes no obligation to update or confirm the accuracy of any information as of a later date.

Non-Agency Profile

Option ARM

Alt-A

Prime

Option ARM

Alt-A

Prime

52%

23%

5%

20%

15

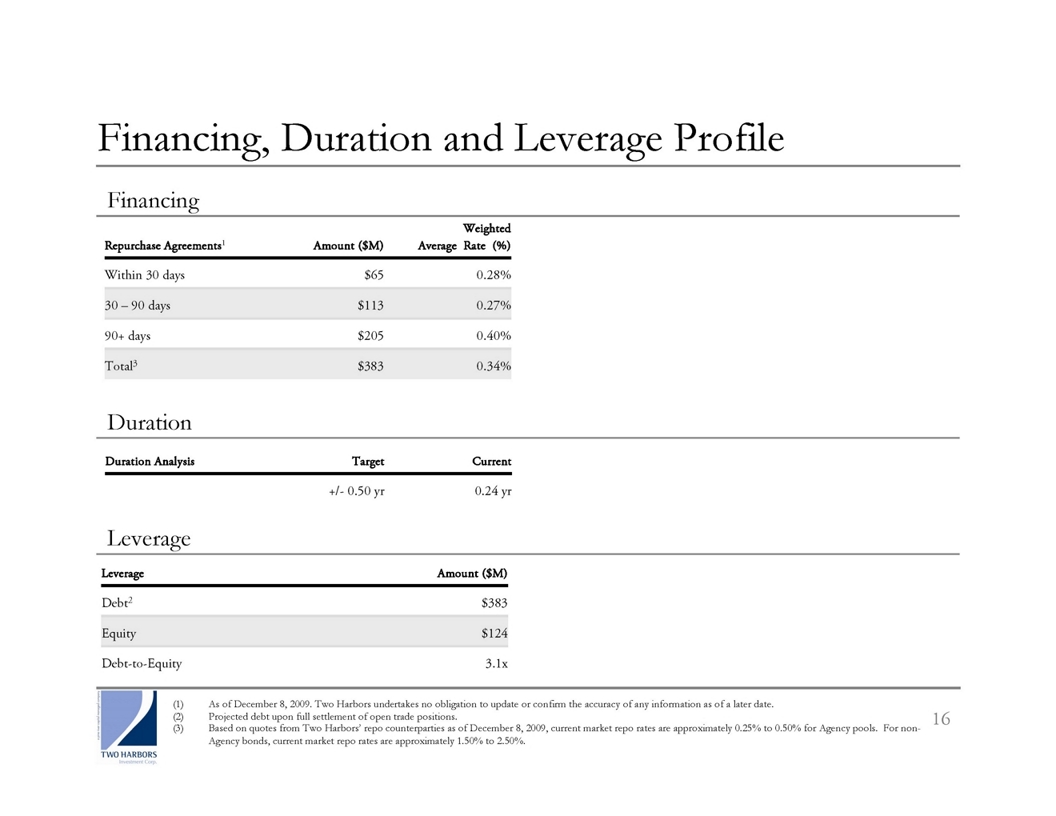

Financing

$383

$205

$113

$65

Amount ($M)

0.34%

0.40%

0.27%

0.28%

Weighted

Average Rate (%)

90+ days

Within 30 days

30 – 90 days

Total3

Repurchase Agreements1

Financing, Duration and Leverage Profile

Leverage

3.1x

$124

$383

Amount ($M)

Debt-to-Equity

Debt2

Equity

Leverage

As of December 8, 2009. Two Harbors undertakes no obligation to update or confirm the accuracy of any information as of a later date.

Projected debt upon full settlement of open trade positions.

Based on quotes from Two Harbors’ repo counterparties as of December 8, 2009, current market repo rates are approximately 0.25% to 0.50% for Agency pools. For non- Agency bonds, current

market repo rates are approximately 1.50% to 2.50%.

Duration

+/- 0.50 yr

Target

0.24 yr

Current

Duration Analysis

16

Appendix

Board of Directors

Brian Taylor, Chairman. Mr. Taylor is the Chief Executive Officer and Chief Investment Officer of Pine River. Mr. Taylor founded

Pine River in 2002 and is responsible for management of the business and oversight of its funds. Prior to Pine River’s inception, Mr. Taylor was with EBF & Associates from 1988 to 2002; he was named head of the convertible arbitrage group in

1994 and Partner in 1997. His responsibilities included portfolio management, marketing, product development, and trading information systems development. Mr. Taylor received a B.S. from Millikin University in Decatur, Illinois and an M.B.A. from the University

of Chicago. Mr. Taylor passed the Illinois Certified Public Accountant Examination in 1986.

Mark D. Ein, Non-executive Vice Chairman of the Board of Directors. Mr. Ein served as Capitol’s Chief Executive Officer

and a member of its Board of Directors since its inception. Mr. Ein is the Founder of Venturehouse Group, LLC, a holding company that creates, invests in and builds companies, and has served as its Chief Executive Officer since 1999. Venturehouse’s

portfolio includes or has included the seed investment in Matrics Technologies in August 2000 (sold to Symbol Technologies in September 2004), the lead investment in the buyout of Cibernet Corporation from the CTIA in March 2003 (sold to MACH S.á.r.l.

in April 2007), the acquisition of VSGi from Net2000 Communications, and an early investment in XM Satellite Radio (NASDAQ:XMSR). He is also the President of Leland Investments, a private investment firm. An entity owned by Mr. Ein is also the majority

owner and managing member of Kastle Holding Company LLC, which through its subsidiaries conducts the business of Kastle Systems, LLC, a leading provider of building and office security systems acquired in January 2007. He is the Co-Chairman of Kastle

Systems. Mr. Ein is also the Founder and Owner of the Washington Kastles, the World Team Tennis franchise in Washington, D.C. From 1992 to 1999, Mr. Ein was a principal with The Carlyle Group, a leading global private equity firm with approximately $59

billion under management. Mr. Ein worked for Brentwood Associates, a leading West Coast growth-focused private equity firm, from 1989 to 1990 and for Goldman, Sachs & Co. in the real estate and mortgage finance group from 1986 to 1989. Mr. Ein is

a director of MACH S.à.r.l. and VSGi (Chairman). He serves on the Board of Directors of The Foundation for the National Institutes of Health (NIH), The Economic Club of Washington D.C., The District of Columbia College Access Program (DC-CAP), The

District of Columbia Public Education Fund, and The Potomac Officers Club. He previously served on the Trustee’s Council of the National Gallery of Art and the boards of the Wolf Trap Foundation, The Washington Tennis and Education Fund, the Executive

Committee of the Federal City Council and the SEED School and Foundation. He was the Co-Chairman of the 2000 Corporate Campaign for The Phillips Collection. Mr. Ein received a B.S. in economics with a concentration in Finance from the University of Pennsylvania’s

Wharton School of Finance and an M.B.A. from the Harvard Business School.

Thomas Siering, Chief Executive Officer and Director. Mr. Siering also serves as Partner—Head of Fundamental

Strategies at Pine River. Prior to joining Pine River as a Partner in 2006, Tom was head of the Value Investment Group at EBF & Associates in Minnetonka, MN. He joined EBF in 1989 and was named a Partner in 1997. From 1999 to 2006, Tom was the portfolio

manager of Merced Partners, LP and Tamarack International Limited. Those funds engaged in a variety of distressed, credit and value strategies. He supervised a staff of thirteen people located both in Minnesota and London. This staff was comprised of traders,

analysts and support personnel. Tom began his career at Cargill, Incorporated where he was a founding member of their Financial Markets Department. He holds a Bachelor of Business Administration degree from the University of Iowa with a major in Finance.

18

Board of Directors Continued…

Stephen G. Kasnet, Independent Director and Audit Committee Chair. Stephen is a Director and Chairman of the Board

of Columbia Laboratories, Inc. (NASDAQ: CBRX). He has been President and Chief Executive Officer of Raymond Property Company LLC since 2007. From 2000 to 2006 he was President and Chief Executive Officer of Harbor Global Company,

Ltd., an asset management, natural resources and real estate investment company, and Chairman of PioGlobal Asset Management. Mr. Kasnet also served as a past director and member of the Executive Committee of The Bradley Real Estate Trust and

served as Chairman of Warren Bank. He has held senior management positions with Pioneer Group, Inc.; First Winthrop Corporation and Winthrop Financial Associates; and Cabot and Forbes. He serves as Chairman of the Board of Rubicon

Ltd. (forestry) and is a director of Tenon Ltd. (wood products). He is also a trustee and vice president of the board of The Governor’s Academy, Byfield, MA. Mr. Kasnet received a Bachelor of Arts from the University of Pennsylvania

in 1966.

William W. Johnson, Independent Director. Mr. Johnson was also a Managing Director of J.P. Morgan from 2006 to 2009, where

he held senior roles including Divisional Management and Risk Committee Member, Head of Proprietary Positioning Business, and Head of Tax-Exempt Capital Markets. From 2004 to 2005, Mr. Johnson was a private investor. From 2001 to 2003, Mr. Johnson was

President of Paloma Partners, a private capital management company in Greenwich, Connecticut. From 1984 to 2001, Mr. Johnson worked for UBS and its predecessors in Chicago, Singapore, London and Basel.

He began his career at UBS in currency options trading and served in several senior management functions including Divisional Management and Risk Committee Member and Global Head of Treasury Products. Mr. Johnson received a B.S. degree from the University

of Pennsylvania Wharton School in 1984, and a M.B.A. from the University of Chicago in 1988.

Reid Sanders, Independent Director. Mr. Sanders is also the President of Sanders Properties. He is a Director of Independent

Bank, serves on the Investment Committee at Cypress Reality, and is on the Advisory Board of SSM Venture Partners. He is the former Chairman at Two Rivers Capital Management, and his former directorships include Harbor Global Company Ltd, PioGlobal

Asset Management, The Pioneer Group and TBA Entertainment Corporation. Mr. Sanders was the Co- Founder and former Executive Vice President of Southeastern Asset Management, and the former President of Longleaf Partners Mutual Funds, a family of funds in

Memphis from 1975-2000. He served as the Investment Officer at First Tennessee Investment Management, the investment management division of First Horizon National Corporation, from 1973-1975. Prior to being at First Tennessee, Mr. Sanders worked in

Credit Analysis and Commercial Lending at Union Planters National Bank from 1971-1972. Mr. Sanders is a Trustee of the Hugo Dixon Foundation, the Dixon Gallery and Gardens, the Hutchison School, Campbell Clinic Foundation, The Jefferson Scholars Foundation,

TN Shakespeare Company, and formerly a Trustee of Rhodes College. He received a Bachelors of Economics from the University of Virginia in 1971.

Peter Niculescu, Independent Director. Since 2009, Mr. Niculescu has also been a Partner and Head of Fixed Income Advisory

at CMRA, a risk management firm providing consulting and litigation support services to major US and international financial services companies and institutional investors. Prior to joining CMRA, Mr. Niculescu ran the Capital Markets division at Fannie

Mae from 2002 to 2008. During the 1990s, he was a Managing Director at Goldman Sachs in its mortgage research and fixed income strategy group. Mr. Niculescu received a Bachelors of Economics from the Victoria University of Wellington in New Zealand in 1979

and his Ph.D. in Economics from Yale University in 1985. Mr. Niculescu is a Chartered Financial Analyst charter holder.

19

Executive Team

Thomas Siering, Chief Executive & Director. Mr. Siering also serves as Partner—Head of Fundamental Strategies at Pine

River. Prior to joining Pine River as a Partner in 2006, Tom was head of the Value Investment Group at EBF & Associates in Minnetonka, MN. He joined EBF in 1989 and was named a Partner in 1997. From 1999 to 2006, Tom was the portfolio manager of

Merced Partners, LP and Tamarack International Limited. Those funds engaged in a variety of distressed, credit and value strategies. He supervised a staff of thirteen people located both in Minnesota and London. This staff was comprised of traders, analysts

and support personnel. Tom began his career at Cargill, Incorporated where he was a founding member of their Financial Markets Department. He holds a Bachelor of Business Administration degree from the University of Iowa with a major in Finance.

Steve Kuhn, Co-Chief Investment Officer. Mr. Kuhn also serves as Partner—Head of Fixed Income Trading at Pine River. Prior

to joining Pine River in 2008, Mr. Kuhn was a Vice President and Portfolio Manager at Goldman Sachs based in New York and Beijing from 2002 to 2007, where he was part of a team that managed approximately $40 billion in mortgage-backed securities. While

he was in Beijing, Mr. Kuhn provided training to sovereign wealth fund clients and voluntarily taught Finance to students from Peking University and Tsinghua University. From 1999 to 2002, Mr. Kuhn was a Japanese convertible bond trader at Citadel Investment

Group in Chicago. Prior to that, Mr. Kuhn was head of mortgage backed securities trading at Cargill in Minnetonka, Minnesota. Mr. Kuhn received a B.A. in Economics with Honors from Harvard University in 1991.

William Roth, Co-Chief Investment Officer. Mr. Roth also serves as Portfolio Manager in the New York Office of Pine River.

Prior to joining Pine River in 2009, Mr. Roth was at Citigroup and its predecessor firm, Salomon Brothers Inc., for 28 years where he was named a Director in 1987 and a Managing Director in 1997. From 2004 to 2009, Mr. Roth managed a proprietary trading

book at Citigroup with particular focus on mortgage and asset-backed securities. From 1994 to 2004, Mr. Roth was part of the Salomon/Citi New York Mortgage Sales Department. From 1981 to 1994, Mr. Roth was based in Chicago and managed the Chicago Financial

Institutions Sales Group for Salomon Brothers. He received an M.B.A. with a concentration in Finance from the University of Chicago Graduate School of Business in 1981, and a B.S. in Finance and Economics from Miami University in Oxford, Ohio in 1979.

Jeff Stolt, Chief Financial Officer. Mr. Stolt also is a Partner—Chief Financial Officer of Pine River. Prior to co-founding

Pine River in 2002, Mr. Stolt was the Controller at EBF & Associates from 1997 to 2002. In this role, Mr. Stolt oversaw the preparation of all fund accounting statements, managed the offshore administrator relationship, managed the audit process

and was responsible for tax planning and reporting. Mr. Stolt began employment with EBF in 1989. Prior to that, Mr. Stolt was an accountant in Cargill, Inc.’s Financial Markets Department from 1986 until 1989. Mr. Stolt received a B.S. degree in Accounting

and Finance from the Minnesota State University in 1986.

Tim O’Brien, General Counsel and Secretary. Mr. O’Brien has served as General Counsel and Chief Compliance Officer

of Pine Rivers since 2007. From 2004 to 2006, Mr. O’Brien served as Vice President and General Counsel of NRG Energy, Inc. Mr. O’Brien served as Deputy General Counsel of NRG Energy from 2000 to 2004 and Assistant General Counsel from 1996

to 2000. Prior to joining NRG, Mr. O’Brien was an associate at the law firm of Sheppard, Mullin, Richter & Hampton in Los Angeles and San Diego, California. He received a B.A. in History from Princeton University in 1981 and a Juris Doctor from

the University of Minnesota Law School in 1986.

20

Executive Team Continued…

Brad Farrell, Controller. Prior to joining Pine River in September 2009, Brad was Vice President, Director, External Reporting

for GMAC ResCap, responsible for external reporting initiatives within the corporate function of GMAC ResCap from 2007 to 2009. From 2002 to 2007 he held various positions in finance and accounting with XL Capital and its affiliates. From

1997 to 2002 he was employed with KPMG. Brad is a Certified Public Accountant, and graduated with a B.S.B.A. from Drake University in 1997.

Andrew Garcia, VP Business Development. Prior to joining Pine River in 2008, Andrew was the Event Driven and Business Combination

Companies (SPAC) specialist in the Capital Markets division at Maxim Group in New York. Before joining Maxim Group, he was the head trader at Laterman & Company. From 2001 to 2005, he covered institutional event-driven and risk arbitrage

investors as a sales trader, equity sales person, and middle markets sales person at Cathay Financial, Oppenheimer & Co., and CIBC Oppenheimer Corp. Andrew holds a B.A. from Kenyon College.

Brian Schuster, Risk Manager. Prior to joining Pine River in 2008, Brian was Vice President at Credit Agricole based in Chicago

from 2005 to 2008, where he was part of a team that managed $25 billion in fund of hedge fund assets. He supervised a staff to select credit, convertible arbitrage, fixed income and capital structure managers. From 2000 to 2005, Brian worked at PPM

America in a variety of positions. His last role was as a Credit Analyst. From 1999 to 2000, Brian worked at Stratford Advisory Group as an Analyst. Brian received a Masters of Business Administration with honors from the University of Chicago in 2006 and

a Bachelors of Science in Finance from DePaul University with high honors in 1999.

21

Contact Information

For further information, please contact:

Anh Huynh

Investor Relations

Two Harbors Investment Corp.

612.238.3348

Anh.Huynh@twoharborsinvestment.com

22